|

Charges

If your provider is levying excessive charges on withdrawals, then you may

be best served transferring to a provider with lower or even zero charges.

It is your right to do this. To benefit from zero charges you may well

consider transferring to a SIPP (a Self Invested Pension Plan). Hargreaves

Lansdown, as an example offer a SIPP with no withdrawal charges. A SIPP may

not be suitable for all as the investment decisions are solely yours.

Hargreaves Lansdown are also a fund supermarket and have hundreds of funds

on offer, as well as gilots, shares and bonds. Financial advice should be

sought if required to decide your investment strategy.

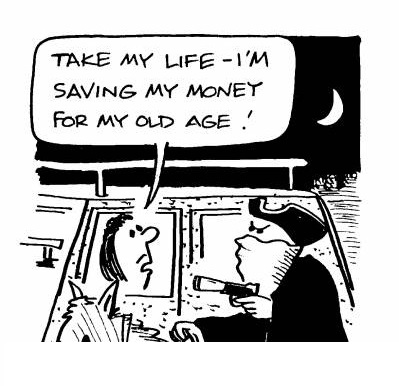

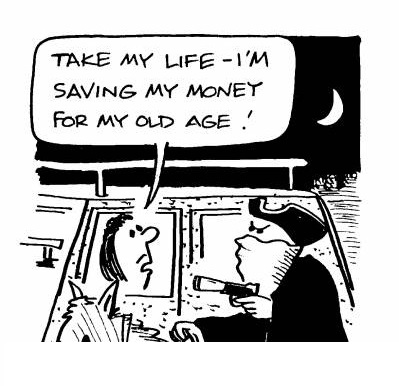

Scams and cons

Savers aren't the only people pleased that they now have complete control of

their pension fund. Scammers and conmen are rubbing their hands in glee at

the opportunity presented to them. Anybody with a pension fund (apart from

those in the Civil Service Pension Scheme) is a potential victim. This page

will attempt to make sure that you're not one of them. Listed below is a

small example of what to look out for when trying to identify a scammer.

-

If you are cold called by someone who wishes to

discuss your pension options then hang up or shut the door. If you

receive an unsolicited email then delete it. If you are

approached whilst out shopping say no thank you and keep walking. Reputable advisors do

not cold call. If you wish to discuss your pension with an advisor then

visit the

Pension Wise website for access to

free impartial advice.

For more detailed investment advice, then contact

a Financial Conduct Authority (FCA) regulated Financial Advisor. You can check

whether a Financial Advisor is regulated at

http://www.fsa.gov.uk/register/home.do For advice on how to

find a regulated financial

advisor visit

https://www.moneyadviceservice.org.uk/en/articles/choosing-a-financial-adviser.

-

Phrases such as 'legal loopholes', 'cash bonus',

'government endorsed', 'pensions liberation', 'loan' and 'one time opportunity' are all phrases

designed to give you confidence, but they are the phrases of a scammer.

The only one that is possibly going to be true is 'one time

opportunity', because the likelihood is that you won't have a pension

fund for there to be a second time!

-

A Company encourages you to

withdraw your whole pension so that

they can invest it for you. Whilst a transfer to an FCA regulated Company

is perfectly reasonable and, more importantly, tax free (see charges,

above), a withdrawal for investment is

not as a withdrawal is taxable, and

you would be presented with a hefty tax bill (see

Tax considerations and calculator) that wipes

away any claimed investment returns, in the event that they do

materialise, for years to come. A reputable Company would be able

to offer you a transfer so if they

encourage you to withdraw to to invest it

is probably a scam.

-

If you send the money overseas (or by Western

Union) then you more than likely won't see it again. That holiday hotel

build which will return you 50% in 6 months doesn't exist. Keep your

money in the UK with a FCA regulated Company.

-

Promises of access to your pension pot before

the age of 55. No matter what you are told you can not access

your pension pot before the age of 55, unless you are retiring

early due to ill health or you are in a scheme with special provisions

(and no reputable advisor would transfer you out of a scheme like that).

If you access your pension pot before the age of 55 then this is known

as an unauthorised payment and unauthorised payments attract a tax

charge of 55%. The scammer won't normally mention the tax charge, of

course. After

tax and fees payable to the scammer, which will be hidden in the smallprint of his contract, you might see £10,000 of your £50,000

pension pot.

-

Websites that are pretending to be the

governments Pension Wise website may also crop up and look to rip you

off. If the website address doesn't begin with

https://www.pensionwise.gov.uk/ the it is not the Pension Wise

website.

Thats just a handful of ways that unscrupulous conmen will try to relieve

you of your pensions savings. The Pensions Advisory Service (TPAS) have

published a more in depth guide and some real life example cases. See

http://www.pensionsadvisoryservice.org.uk/publications-files/uploads/members_detailed_booklet_7_page.pdf

|